The one thing I can generally say about Jaron Lanier is that he definitely makes me think…

The one thing I can generally say about Jaron Lanier is that he definitely makes me think…

Please notice how similar music is to mortgages.

When a mortgage is leveraged and bundled into complex undisclosed securities by unannounced third parties over a network, then the homeowner suffers a reduced chance at access to wealth. The owner’s promise to repay the loan is copied, like the musicians’ music file, many times. So many copies of the wealth-creating promise specific to the homeowner are created that the value of the homeowner’s original copy is reduced. The copying reduces the homeowner’s long-term access to wealth.

To put it another way, the promise of the homeowner to repay the loan can only be made once, but that promise, and the risk that the loan will not be repaid, can be received innumerable times. Therefore the homeowner will end up paying for that amplified risk, somehow. It will eventually turn into higher taxes (to bail out a financial concern that is “too big to fail”), reduced property values in a neighborhood burdened by stupid mortgages, and reduced access to credit.

Access to credit becomes scarce for all but those with the absolute tip-top credit ratings once all the remote recipients of the promise to repay have amplified risk. Even the wealthiest nations can have trouble holding on to top ratings. The world of real people, as opposed to the fantasy of the “sure thing,” becomes disreputable to the point that lenders don’t want to lend anymore.

Once you see it, it’s so clear. A mortgage is similar to a music file. A securitized mortgage is similar to a pirated music file.

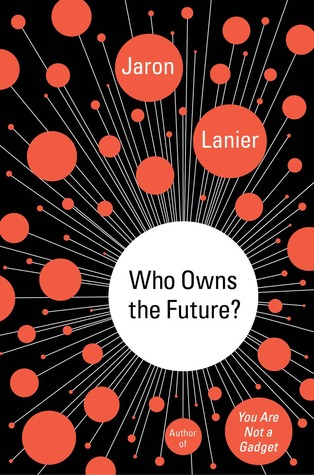

Read the full article on Wired.com or buy the whole book: Who Owns the Future.